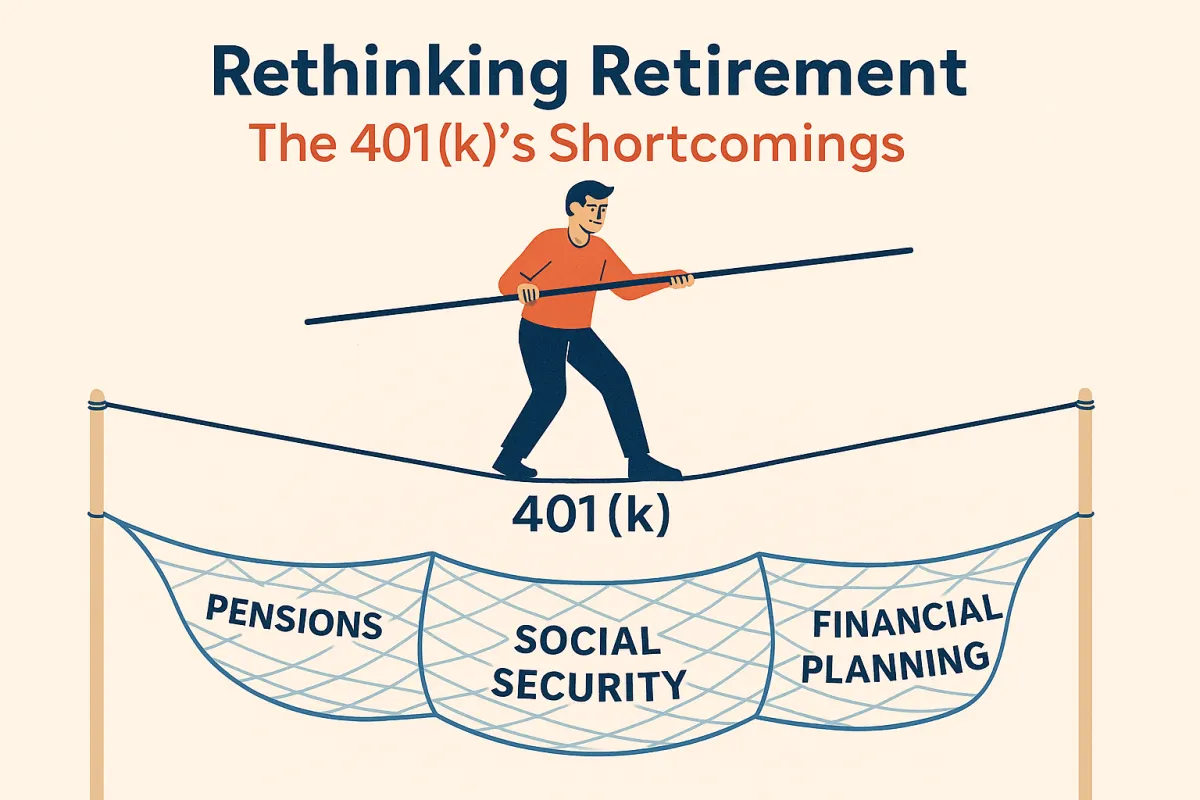

Rethinking Retirement: The 401(k)'s Shortcomings and How to Secure Your Future

When the 401(k) plan emerged in the late 1970s, it was designed to complement traditional pensions, not replace them. However, over time, it became the primary retirement savings vehicle for many Americans. This shift transferred the responsibility of retirement planning from employers to individuals, many of whom lack the financial literacy or resources to manage it effectively

The Challenges of the 401(k) System

Lack of Financial Expertise: Most individuals are not trained investors. They may make impulsive decisions during market downturns or fail to diversify their portfolios adequately

Hidden Fees: Even small annual fees can significantly erode retirement savings over time. Many are unaware of these costs and their long-term impact.

Inconsistent Participation: Unlike pensions, 401(k) plans require individuals to opt-in and contribute regularly. Factors like low income, student debt, or lack of financial knowledge can hinder consistent contributions.

These challenges highlight the need for a more comprehensive approach to retirement planning.

Building a Robust Retirement Strategy

At TheRightRetirementPlan.com, we believe in empowering individuals with the knowledge and tools to make informed decisions about their retirement. Here's how we can help:

Personalized Planning: Our resources guide you through creating a retirement plan tailored to your unique circumstances and goals.

Expert Guidance: We connect you with vetted financial advisors who prioritize your best interests and can help navigate the complexities of retirement planning.

Educational Resources: Access our library of articles, videos, and tools designed to demystify retirement planning and help you make confident decisions.

Don't let the limitations of the 401(k) system jeopardize your retirement. Take proactive steps today to secure a comfortable and stable future.